Budget Crunch Meets Electric Car Debate: Chaplik Pushes Back on Tax Hikes

State 48 News Exclusive: Rep. Joseph Chaplik weighs in on Arizona’s budget crisis, and how Arizona could benefit from a “DOGE”-style approach to cut waste and tighten spending.

Beneath Arizona’s debate over electric vehicles lies a much bigger crisis — a billion-dollar budget deficit rattling lawmakers and taxpayers alike. What began as questions about EVs and road funding has now widened into a discussion over spending, accountability, and the future of the state’s finances. In a State 48 News exclusive, Rep. Joseph Chaplik (R-LD3) points to what he says are costly missteps at the top, raising the stakes far beyond traffic and technology.

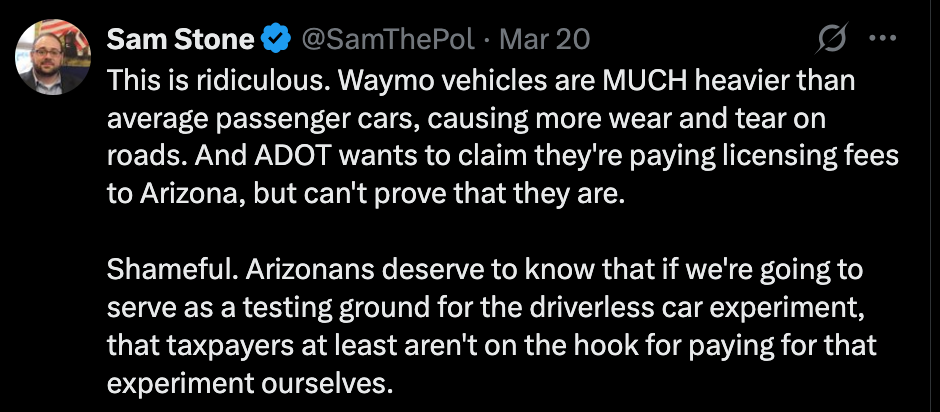

Earlier in the week, Sam Stone, former chief of staff to Phoenix Councilman Sal DiCiccio and now serving in the same role for Maricopa County Recorder Justin Heap, recently raised a hot-button issue that caught our attention — and we decided to dig deeper.

In a pointed critique, Sam Stone questions why Waymo, the autonomous vehicle company, registers its self-driving fleet in California while operating extensively on Arizona roads. His concern centers on the idea that these "overweight rolling roadblocks" are using Arizona infrastructure without directly contributing to its upkeep through local registration fees.

Arizona Department of Transportation (ADOT) Response Summary:

ADOT clarifies Waymo and similar companies operate under the International Registration Plan (IRP) — a multi-state agreement governing the registration of commercial vehicles traveling across jurisdictions. Under this system, companies select a base state (in this case, California) to register their fleets but are still required to pay road usage fees to other states, including Arizona, based on the percentage of miles driven in each jurisdiction. This means Arizona does receive apportioned fees from Waymo and others, proportional to their actual use of Arizona roads, even if their license plates show a different state.

The Full Reciprocity Plan (FRP), which became effective Jan. 1, 2015, has made the Plan more efficient, more equitable and more flexible for its member jurisdictions and registrants by granting full reciprocity for all apportioned vehicles in all member IRP jurisdictions and removing from the Plan any provisions related to estimated distance.

Arizona Department of Transportation | Motor Vehicle Division

All bordering U.S. states, the District of Columbia, and some Canadian provinces are part of this agreement.

In response to the response, Stone says the practice is “shameful.”

We pressed Rep. Joseph Chaplik for his take, and he didn’t hold back. Not only does he see this issue differently — our conversation quickly turned to a much bigger problem: Arizona’s looming billion-dollar deficit, and who he says is to blame.

“The big question is, how do you get the electric vehicles to pay for their fair share of the road for wear and tear if they don’t get gasoline?”

Chaplik calls it an important conversation, one that ties into broader questions about electric vehicles and how to manage them fairly. He says he’s committed to his promise not to raise taxes or impose new fees on voters, but admits he’s weighing the impact. With electric vehicles still making up a smaller share compared to gas-powered cars, Chaplik says it’s unclear how much of a difference it’s making.

“Now I think the small percentage of electric cars are very few to all the gas-powered vehicles on the road today. I’m also a conservative and a Republican and I will not vote for a tax or a fee. On anything. So the argument is, ‘Should we tax them or not?’ I’m on the side I say ‘no’. I don’t think we should tax them. Now the Waymo thing surfaces. They’re not paying any taxes for the road, but they’re driving on the roads.”

Rep. Joseph Chaplik (R-LD3) | March 21, 2025

Chaplik then points to the Department of Government Efficiency (DOGE) as an example of how cutting waste, fraud, and abuse at the federal level is making an impact. He believes Arizona can take a similar approach — reducing inefficiencies while still growing the state’s economy. Chaplik says he’s confident the state can remain financially healthy by focusing on smart spending and cutting income taxes to boost growth.

“I think we have the same here in Arizona. Abuse. Fraud. Taxation is plenty. And we lowered our tax to 2.5%. And we still have ends meet with our income tax going to 2.5%. I’d love to get to zero. I think we are a very healthy state. I think if you grow the state with population, with having a low tax or zero tax, you’ll get that money somewhere else. Which is the economy booming,” explains Chaplik.

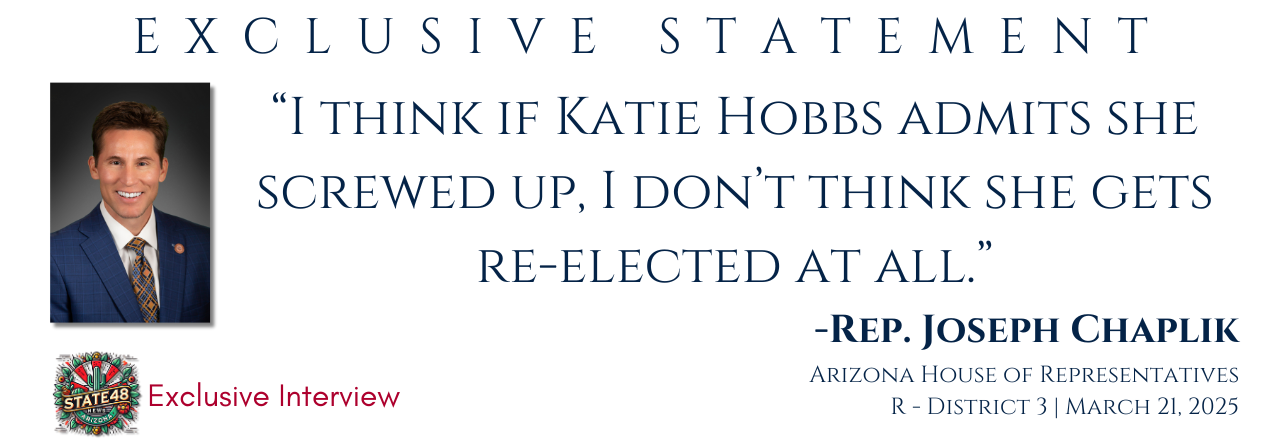

State 48 News Senior Investigative Journalist Jennifer Barber asked Rep. Chaplik about Arizona’s deficit. He pointed to the executive branch, blaming Governor Katie Hobbs’s executive branch and overspending. “They screwed up and let's fix it,” Chaplik said. He also acknowledged Arizona’s divided government, with a Democratic governor and a Republican-controlled House and Senate.

“But we’re not working together. They should come to the table. Admit their faults. And let’s figure out a solution. And we’re working on a solution as a legislature. But both parties have to agree at the end of the day - but politics play in place. I think if Katie Hobbs admits she screwed up, I don’t think she gets re-elected at all.”

State 48 News is following this story. Please be sure to set alerts on X for the latest.